In Malta which is a hub for financial services and the online gaming sector anti-money laundering compliance is an important aspect of the commercial environment in which companies operate. Malta has passed the Moneyval assessment after strengthening its ant-money laundering regime government sources have confirmed.

Anti Money Laundering 2021 China Iclg

In the ninth edition published on Thursday the rapid decline now places.

Maltas anti money laundering program is. Increased scrutiny in Malta the EU and worldwide means that Anti-Money Laundering and Combatting Financing of Terrorism AMLCFT issues are on the local and international agenda Reputation Risk The recent introduction of a name and shame policy by the FIAU increases the reputational risk for any organisation found in breach of local AMLCFT. The Council of Europe body had given Malta until last year to conduct an overhaul of its anti-money laundering legislation. Anti-money laundering and the combatting of financial terrorism AMLCFT are principally regulated by the Prevention of Money Laundering Act Chapter 373 of the Laws of Malta PMLA and its subsidiary legislation the Prevention of Money Laundering and Funding of Terrorism Regulations Subsidiary Legislation 37301 of the Laws of Malta PMLFTR which have effectively.

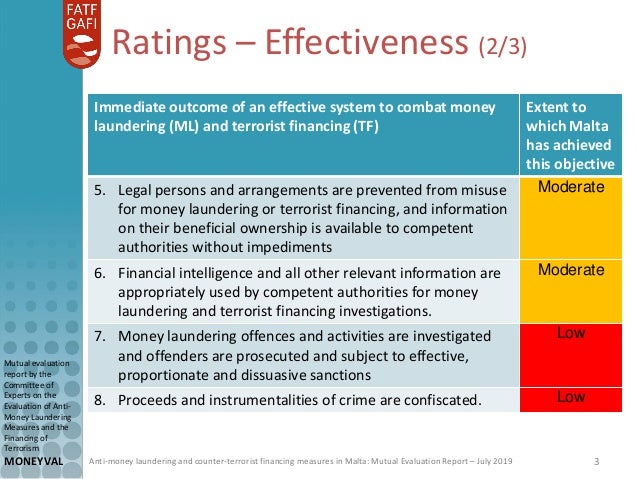

This report provides a summary of the anti-money laundering AML and countering the financing of terrorism CFT measures in place in Malta as at the date of the onsite visit 5-16 November 2018. According to that Evaluation Malta was deemed Compliant for 12 and Largely Compliant for 28 of the FATF 40 Recommendations. The Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism MONEYVAL is a monitoring body.

Malta retains minor deficiencies in the implementation of another twenty-eight Recommendations where it has been found largely compliant. Anti-Money Laundering AML in Malta Money laundering is the legalization process of revenues from criminal activities. The FIAU is a governmental agency having a distinct legal personality.

Malta has plummeted 60 places in the span of a year in the Basel Institutes Anti-Money Laundering Index dropping from its low risk 113th place in 2019 to 53rd place in 2020. While the Financial Intelligence Analysis Unit FIAU established under the Prevention of Money Laundering Act Cap 373 of the Laws of Malta PMLA is the national agency with the responsibility for prevention of money laundering and financing of terrorism and has the function to supervise compliance by all subject persons including. The last Follow-up Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Malta was undertaken in 2021.

Malta has achieved full compliance with twelve of the 40 FATF Recommendations constituting the international AMLCFT Anti-Money Laundering and Countering the Financing of Terrorism standard. Maltese Legislation The various laws and standards aimed at combating money laundering and terrorist financing are being continually updated on international and local levels to respond to the evolving threats posed by criminals and terrorists. The price of non-compliance can be great.

Aside from the real risk of criminal prosecution and administrative sanctions AML shortcomings can have. The Prevention of Money Laundering Act Chapter 373 of the Laws of Malta defines money laundering as the conversion or transfer of property knowing or suspecting that such property is derived directly from or the proceeds of criminal activity or from an act or acts of participation in criminal activity for the purposes of concealing or disguising the origin of the property or of assisting. Money laundering poses important threats all over the world.

It analyses the level of compliance with the Financial Action Task Force. Enrichment of criminals with the income they earn from crimes can enable them to commit more significant crimes. Furthermore Malta is part of MONEYVAL the Select Committee of Experts on the Evaluation of Anti-Money Laundering Measures formerly PC-R-EV established in September 1997 by the Committee of Ministers of the Council of Europe to conduct self- and mutual- assessment.

Malta has pledged to focus its financial intelligence capabilities on tax evasion and money laundering in a commitment to the Financial Action Task Force. It is responsible for the collection collation processing analysis and dissemination of information of suspected money laundering or terrorist financing activities in order to combat money laundering and terrorist financing in Malta. As a European Union member state Malta has implemented all EU Directives regulating the prevention of money laundering.

Should Malta fail within one year to remedy the many defects in its anti-money laundering program it will be designated a High-Risk Jurisdiction which is MONEYVALs blacklist a step guaranteed to seriously damage the countrys financial industry. Government in Malta disputes the findings of fact made by MONEYVAL.

The Malta Gaming Authority Sets Up A New Anti Money Laundering Supervisory Unit Iagr Leading The World In Gaming Regulation

Eu To Check On Money Laundering Moves In Malta Journalist S Murder Voice Of America English

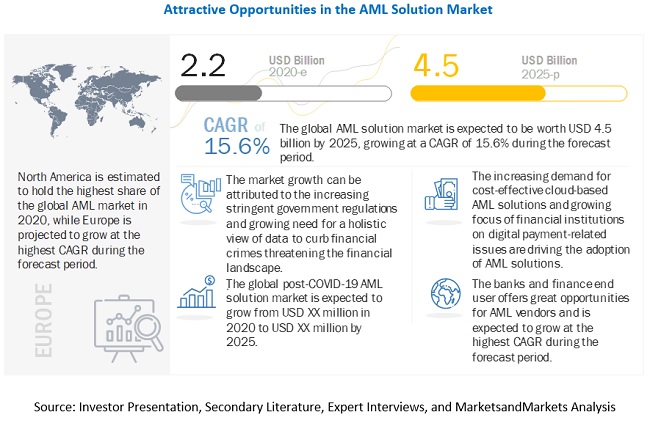

Anti Money Laundering Market Size Share And Global Market Forecast To 2025 Marketsandmarkets

Handbook Of Anti Money Laundering Pdf Money Laundering Money Anti

Malta No Longer Non Compliant Rules Eu Anti Money Laundering Body

Infocredit Group Lexisnexis Risk Solutions Sponsor The Anti Money Laundering Conference In Malta Infocredit Group Securing Ease Of Mind

Anti Money Laundering Malta Aml Software Silo Compliance

Malta Money Laundering And Financial Crime

Anti Money Laundering Malta Professional Vixio

Anti Money Laundering Malta Professional Vixio

Anti Money Laundering Malta Professional Vixio

Moneyval Malta Mutual Evaluation Ratings

Streamline Anti Money Laundering Aml Compliance

Anti Money Laundering Malta Professional Vixio

Anti Money Laundering Malta Professional Vixio

Cryptocurrency Anti Money Laundering Report Q4 2018 Ciphertrace

Anti Money Laundering Malta Professional Vixio

Do Anti Money Laundering Requirements Solve Fake Residency Concerns Tax Justice Network