Banking for a Better World asserts that sustainable development is not only doable but also desirable for all. -- In high-income countries the rich and the poor alike have bank accounts but this is not true in developing countries according to a GallupWorld Bank study.

Financial Stability Review May 2020

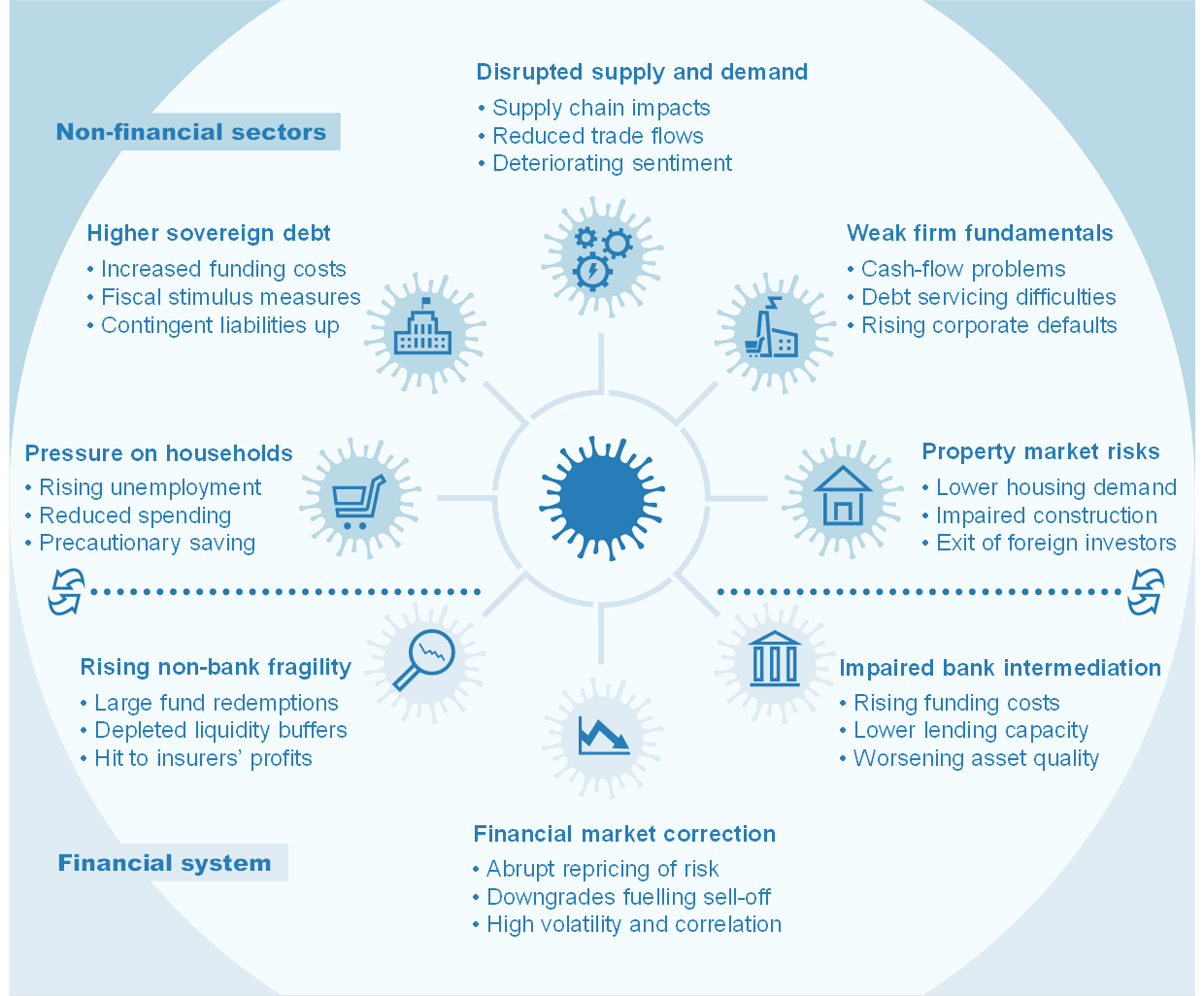

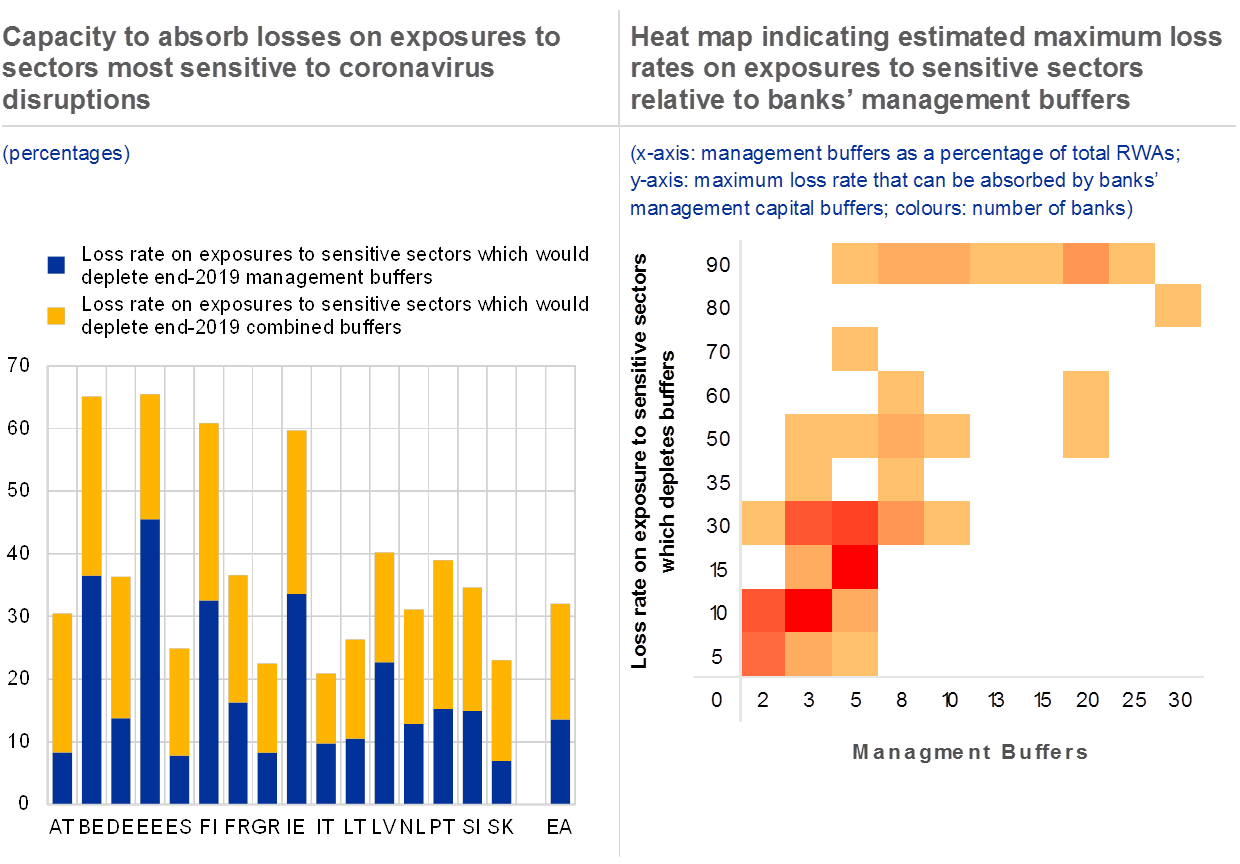

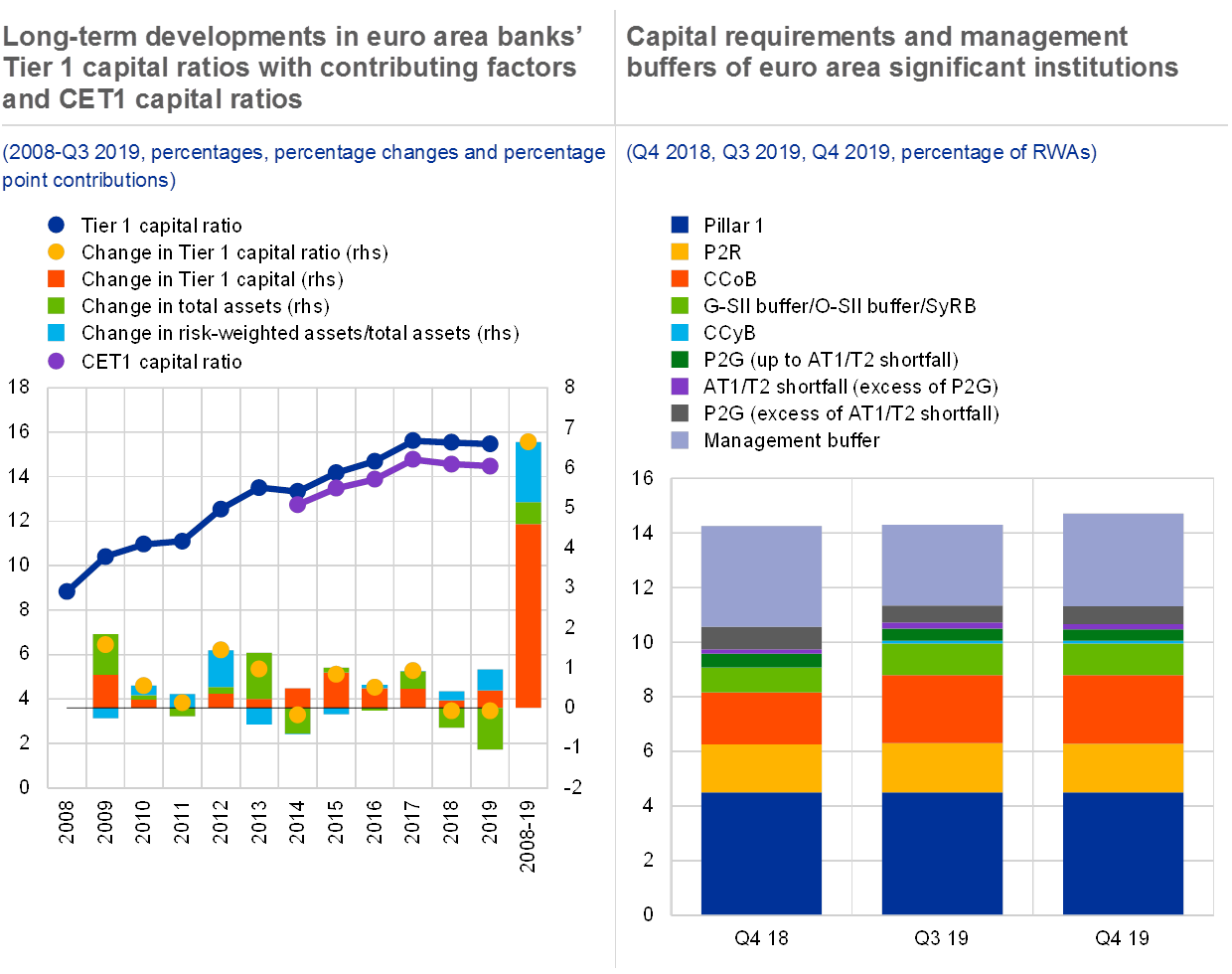

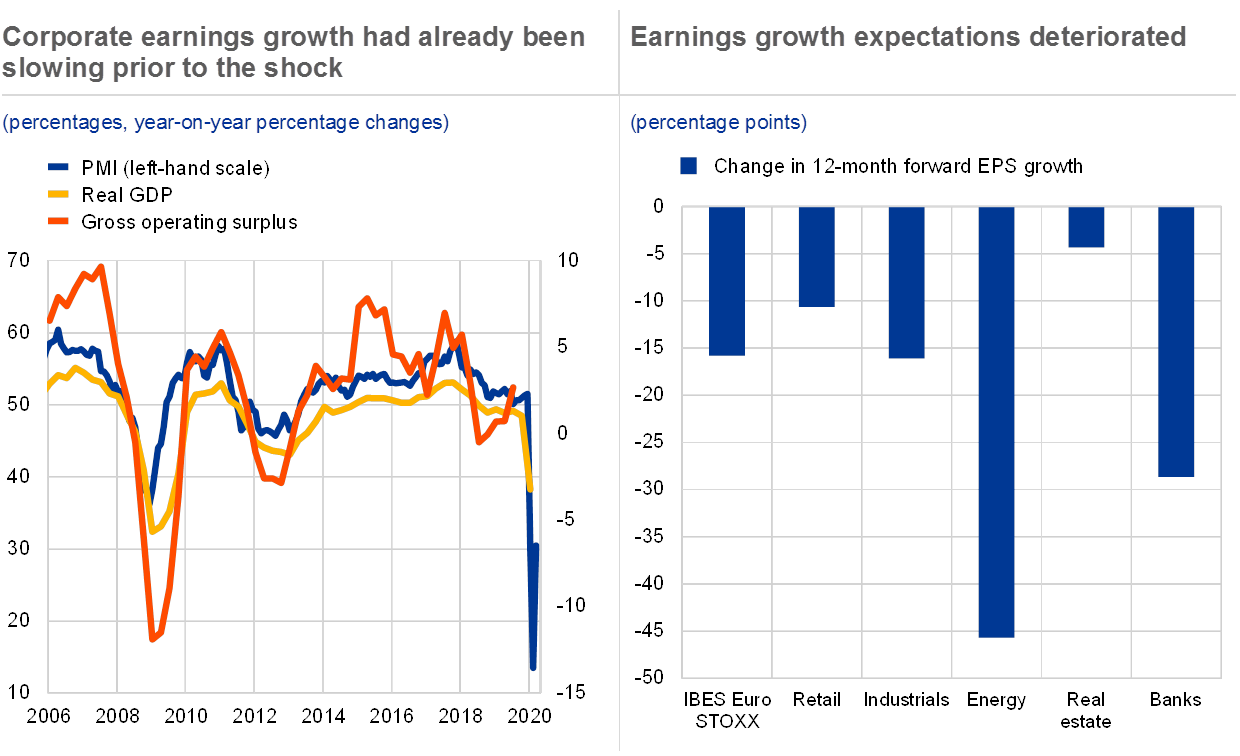

What can be avoided is widespread systemic failure where a large part of the banking system is paralysed.

Banks in developing world can eliminate. Being more familiar with developing-country culture they tend also to be better than developed-world banks at serving small and medium-sized enterprises SMEs and households. All but a few developing countries with central banks devalued against their anchor currency-typically the dollar-at least once during the period. In nineteen eighty-three the project was turned into an independent bank owned mainly by its borrowers.

He pointed out to top executives that every country the IMFWorld Bank got involved in ended up with. In developing countries 46 of adult men say they have an account but only 37 of women. The solution in the developed world has to date been to bury bad debt in opaque places to print money and to recapitalise banks.

The European Investment Bank the largest MDB doubled its paid-in capital and is playing a central role in implementing the European Commissions so-called Juncker Plan which aims to generate 500 billion 561 billion of additional. Isolated bank failures are inevitable and it would be unwise to aim for zero tolerance. Its main concern is to reduce poverty and support development projects in the developing countries.

Section 1 of the paper reviews recent experience in the developing and transitional world. The World Bank and regional multilateral development banks MDBs sharply increased their lending during and after the 2007-2009 financial crisis. Billion people the expected world population in 2050 live well and within the planets ecological limits.

For many years the World Bank has produced and used income classifications to group countries. The bank has been criticized as foisting free-market ideology on developing. New Evidence of Impacts in Developing Countries a joint publication released today by The World Bank Group and the World Trade Organization presents eight case studies that demonstrate ways trade can help reduce poverty in developing countries.

For over 150 years they have planned to take the world over through money. Banking displays a significant gender gap. In the 2016 edition of its World Development Indicators the World Bank has made a big choice.

The former chief economist of the World Bank Joe Stiglitz was fired recently. BitPesa is trying to remove one of the biggest obstacles to entrepreneurship in developing nations. On the upside it is likely to increase local competition and spur financial development.

The World Bank is a group of five multilateral institutions that aim to eradicate global poverty. Economists are no different. Yunus won the Nobel Peace Prize in two thousand six for his work with Grameen Bank.

The global financial crash of 2008 forced many big banks to cut ties with financial institutions in developing countries with West Africa and other key emerging markets EMs swiftly being cut off with severe consequences. The World Bank-IMF is owned and controlled by Nathan Mayer Rothschild and 30 to 40 of the wealthiest people in the world. The bank works in relation.

The low lower-middle upper-middle and high income groups are each associated with an annually updated threshold level of Gross National Income GNI per-capita and. Only the reach and efficiency of digital finance can sustainably bank the next billion people. Global trade has been a significant contributor to poverty reduction.

World Bank is an international financial institution that provides financial assistance to countries or business to achieve their goals. The richest adults in developing countries are more than twice as likely as the poorest adults to have a bank account -- 62 vs. Syndicated lending by groups of banks in developing countries has risen from only around 700m in 1985 to 62 billion by 2005 according to the World Banks 2006 Global Development.

During the Bretton Woods period 1946-1971 central banks in developing countries that had signed the Bretton Woods agreement carried out more than 150 devaluations. The continued digital transformation of financial services is critical to both objectives. Development banks will be essential in bringing about the much-needed.

This internal bank for reconstruction and development IBRD provides loans to both private and public sectors. Comparing the classification of countries. The World Bank Group has set a goal of Universal Financial Access by 2020 and IFC has a long-standing commitment to financial sector development.

Humans by their nature categorize. GENEVA Switzerland December 11 2018 Trade and Poverty Reduction. Unbanked residents of developing countries are often unable to enter the import or export business because they have no way to convert their currencies into more widely accepted money such as the US dollar.

Its no longer distinguishing between developed countries and developing ones in the. The bank takes a mixed view of the growth of South-South lending. Lack of access to banks.

United Nations Development Programme Undp 1997 Human Development Report 1997 Human Develo Development Programs Human Development Human Development Report

Dealroom Helps Users Eliminate Duplicate Work And Allows Them To Focus On What Really Matters Closing Deals Faster Projec Machine Learning Finance To Focus

Mike Quindazzi On Twitter Wealth Management Robo Advisors Machine Learning

Financial Stability Review May 2020

Our Bhaisepati Branch Has Started Operating On Extended Banking Hours For Your Ease And Flexibility For Further Details Please C In 2021 Banking Customer Care Branch

Are You Ready For The Future Of Global Banking Banking Are You Ready Global

Financial Stability Review May 2020

Smart Stimulus Cash As Code Fun To Be One Coding Mobile Payments

Financial Stability Review May 2020

The Next Fintech Global Open Finance Infrastructure Fintech Finance Financial Institutions

8 Things You Probably Didnt Know About Impact Of International Trade On Developing Countries Developing Country African Development Bank Economic Development

The Economist On Instagram A Quick Jargon Buster Here Purchasing Power Parity Is The Notion That In The Long Run Exchange Rates Should Move Towards The Rat

Robotic Process Automation For Fintech Fintech Financial Organization Financial Institutions

United Nations Secretary General S High Level Panel On Digital Cooperation The Age Of Digital Development Programs Human Development Human Development Report

Smedan And Bank Of Agriculture Boa Open N5m Loan To Support Businesses Enterprise Development Business Support Small And Medium Enterprises

Financial Stability Review May 2020

Customer Analytics Is Key To Growth In Banking Predictive Analytics Sentiment Analysis Social Media Analysis