So the amount of dirty money. The financial-services industry has been disrupted and roiled by a perfect storm of forces.

Visualized What Countries Hold The Most Money In Circulation Https Sbee Link 8d4vx6mkhn Shared From Howmuch By Catchcc World Money Country

Complex regulatory-compliance requirements aging legacy.

Recent major global money laundering. Thousands of clients were booted out of bank accounts in major wealth hubs including Hong Kong and Singapore after a money laundering scandal in Malaysia the Panama Papers expose and a global push for tax. An article on New York Post estimated that 10 billion of Chinas money is laundered every month. The United Arab Emirates.

One of the biggest global banks was accused of helping the Iranian government launder close to 265 billion due to poor oversight and lack of checks in place. The major source of illicit funds is likely from financial crimes and corruption rather than drug or organized criminal gang activities. One of the first tasks of the FATF was to develop Recommendations 40 in all which set out the measures national governments.

Oct 8 2020 7 min read. The scandal has now been called the largest. Whether it was hiding high valued items in sacks of grain or as in more recent cases routing illegal transactions through hastily formed.

In recent years money laundering is rapidly growing. Malta placed on global money laundering watchdogs grey list By KEVIN SCHEMBRI ORLAND June 25 2021 GMT VALLETTA Malta AP A watchdog on the lookout for money laundering and terror financing said Friday it has placed the tiny Mediterranean island nation of. Five commercial banks operating in Kenya were fined 375 million due to disruptions in AML compliance processes.

Major Money Laundering Countries. By Sven Stumbauer Senior Advisor Norton Rose Fulbright LLP. The organization paid close to 350 million in fines in 2012 and another 350 million in 2014 for not improving their AML compliance as they had promised when they paid the first fine.

In response to mounting concern over money laundering the Financial Action Task Force on money laundering FATF was established by the G-7 Summit in Paris in 1989 to develop a co-ordinated international response. According to the International Monetary Fund IMF the money laundering rate is between 2-5 percent of the worlds GDP. Despite massive global efforts money laundering continues to be extraordinarily feasible.

Danske Bank 229 Billion This is the most recent scandal on our list as it became international news in 2018 but the repercussions are ongoing. A key piece in the global money laundering puzzle 11 May 2020 By the normal standards of the Financial Action Task Force FATF a recent report into attempts by the United Arab Emirates to combat money laundering and terrorist financing is damning to say the least. The authors model suggests a global money laundering total of 285 trillion per year heavily concentrated in Europe and North America.

The Next Wave of Anti-Money Laundering Enforcement Globally Is on the Horizon. By internationalbanker March 3 2021. In June 2018 Australias biggest bank Commonwealth Bank of Australia CBA agreed to pay US534 million to settle civil proceedings relating to more than 50000 breaches of anti-money laundering and counter-terrorism financing AMLCFT laws between 2012 and 2015.

There are reports published and researchers have tried to summarize and quantify amounts involved in money laundering activities. The top money laundering cases in recent times Money laundering has been a go to for countless criminals since taxes were first levied. White-collar criminals have shifted their activities to less-regulated sectors such as jewellery antiquities gold diamonds and real estate.

This ratio corresponds to. Money laundering is one of the largest crimes the global economy has been dealing with for centuries and it is growing. Kenya Fines 5 Banks 375 Million for Anti-Money Laundering Violations.

KCB Group KCBNR Equity EQTYNR Co-op Bank Kenya COOPNR StanChart Kenya SCBKNR and Diamond Trust DTKNR are 5 banks that faced AML fines. Global banks in recent years have boosted investments in technology and staff to deal with tighter anti-money laundering and sanctions regulatory requirements across the world.

One Of Australia S Biggest Bank Westpac Had Warnings Years Ago On Anti Money Laundering Breaches Lea Anti Money Laundering Law Money Laundering Internal Memo

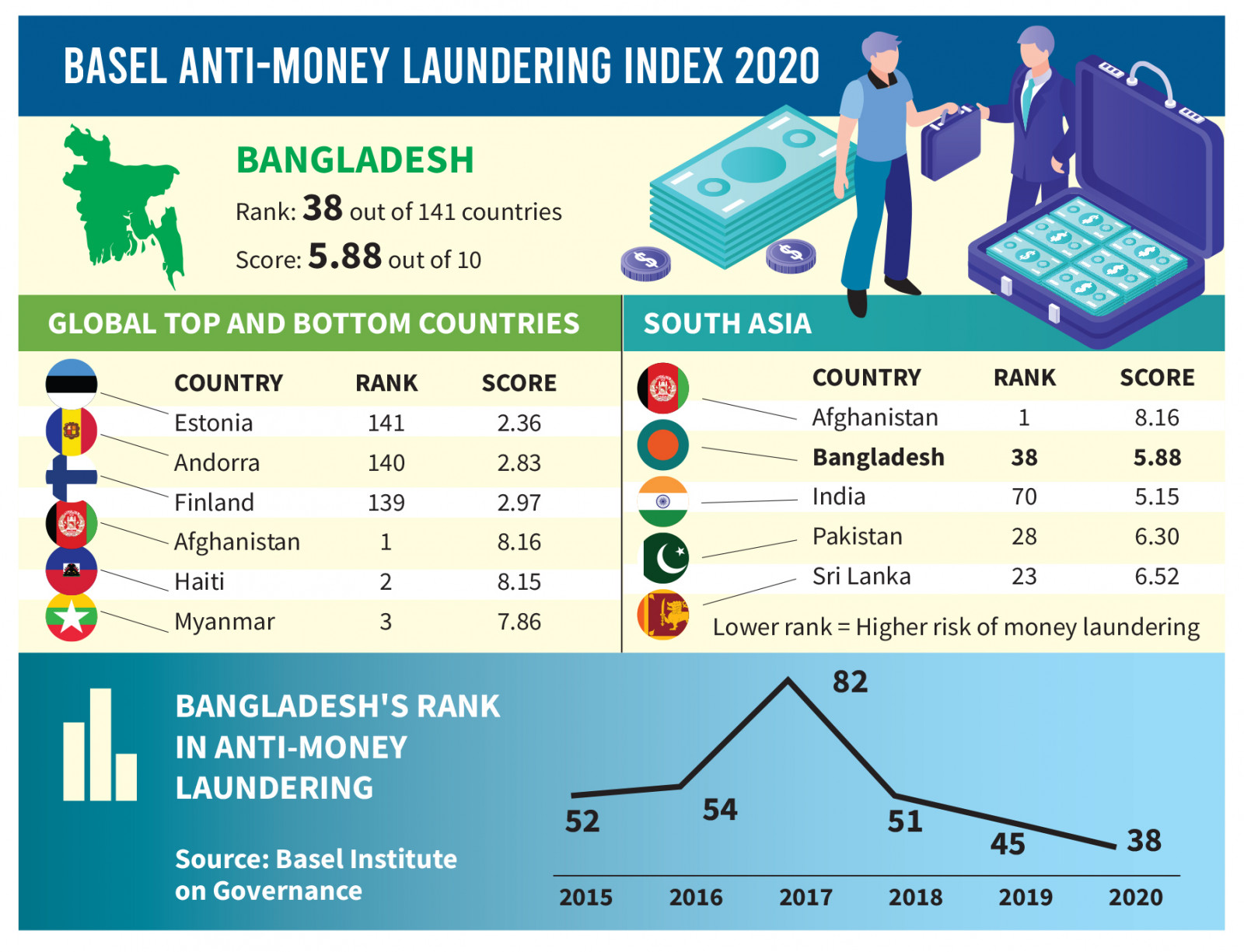

Money Laundering Risk Increases In Bangladesh

How Rapid Urbanisation Is Shaping The Future Insights Uk Ishares Developed Economy Ishares Insight

New 2020 Swiss Crypto Law To Prevent Money Laundering Prevention Money Laundering Cryptocurrency News

Money Laundering Money Laundering Money Global Economy

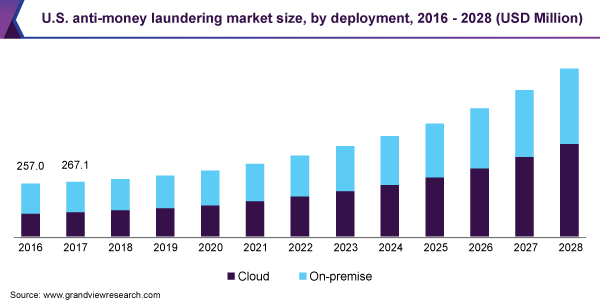

Anti Money Laundering Market Size Report 2021 2028

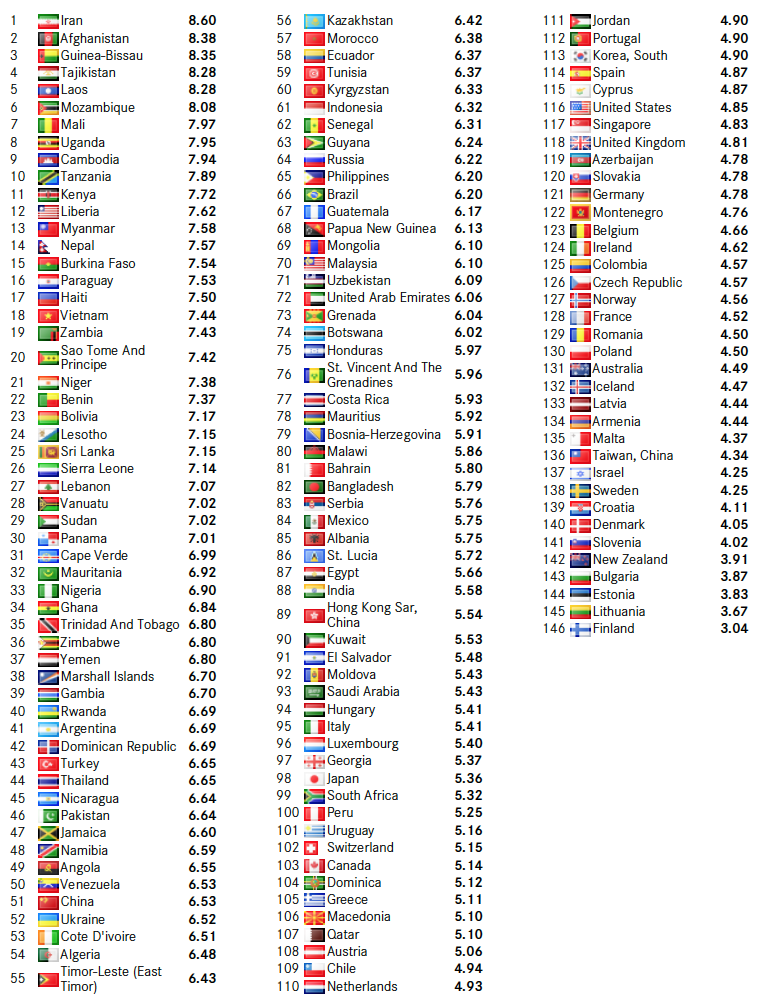

Global Money Laundering Risk Index Rises With Iran Rated Worst And Finland Least Risky Ctmfile

Tim Bennett Explains Money Laundering How The World S Biggest Financial Crime Affects You Youtube Money Laundering Finance Plan Crime

Mexico Real Estate Blog How Do Anti Money Laundering Regulations Affect Buying And Selling Prope Money Laundering Mexico Real Estate Anti Money Laundering Law

What Can We Learn From Recent Money Laundering Cases Basel Institute On Governance

Casino Govt Regulations Include Safeguards Designed To Prevent Money Laundering By Junkets Infographic Money Laundering Prevention Infographic

Money Laundering Risk Increases In Bangladesh

Corruption And Money Laundering The Nexus Way Forward

Pin By Sebastian Tamas On Infographics Banking Industry Financial Institutions Infographic

Anti Money Laundering Software Market Insights Latest Technology Update Global Demand Client A Money Laundering Latest Technology Updates Technology Updates