In 2017 the Federal Reserve Board issued a CD against the. Paraguay AML Fines 2020.

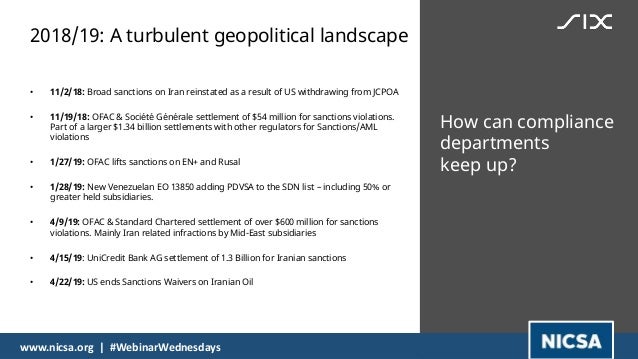

The optimal approach to monitoring trading desks for money laundering and sanctions violations or even violations of currency control would be to integrate market surveillance systems with AML monitoring systems.

When banks with aml violations rebrand. When discussing the BSA violations at Lone Star National Bank FinCEN stated. You can launder money so many different ways. Its as unique as snowflakes said Robert Mazur a former-undercover agent who infiltrated Pablo Escobars drug cartel.

2021 is shaping up to be another blockbuster year for AML-related fines. In addition the OCC announced the imposition of a 50 million civil penalty against Rabobank due to its finding that the banks AML program was deficient. More Banks Sanctioned for AML Fraud-Related Violations.

The data shows that fines for all violations totalled US1421 billion in the year with the US imposing by far the heftiest fines totalling US1111 billion or. More Banks Sanctioned for AML Fraud-Related Violations. More Banks Sanctioned for AML Fraud-Related Violations.

Banks or the banking sector are under the AML obligations because they are at risk of financial crime. The fine was the largest in Paraguays history and the second the bank faced in two years. When banks with aml violations rebrand themselves govern yourself accordingly This weeks news about the termination of a regulatory Consent Order at Miamis Brickell Bank by the FDIC is good news but remember the compliance rule.

September 18 2018 Crypto Flash News. By country Switzerland was the biggest offender after a tier one Swiss bank received the biggest single fine at 51bn for AML breaches by the French Criminal Court. September 18 2018 Crypto Flash News.

A Flurry of AMLBSA Enforcement Cases. The financial institution failed to report suspicious activity to the regulator. As part of a broader resolution Socit Gnrale agreed to pay 95 million to DFS specifically in connection with alleged AML compliance program failures at Socit GnralesNew York branch.

Bank for his alleged failure to prevent Bank Secrecy Actanti-money laundering BSAAML violations that took place during his tenure1. KCB Group KCBNR Equity EQTYNR Co-op Bank Kenya COOPNR StanChart Kenya SCBKNR and Diamond Trust DTKNR are 5 banks that faced AML fines. In this report we share the total numbers summaries of each fine and actionable takeaways that compliance and AML professionals can learn from.

Unfortunately bank systems are typically siloed by the areas they monitor such as AML market surveillance and risk. The European Central Bank ECB has terminated the license of Anglo-Austrian Bank better known as Bank Meinl amid allegations of anti-money laundering AML compliance failures the Financial Times reported Friday. From January 1 to March 31 2021 17 banks were fined over 1250521695 and 910192215.

Rabobank agreed to forfeit 368701259 to the US government as a result of its AML program failures. And many many banks show that regulations are largely ineffective in preventing this type of violations especially when they are committed by the big traditional players. ACE inherently follows Bank Secrecy Act guidelines making it easier for banks to comply with AML requirements and avoid risk that leads to investigations and fines.

There are hundreds of local and global regulators in total doing AML studies in the world. AML regulations contain measures that companies must take to detect and prevent financial crimes and these regulations are determined by AML regulators and are a guide for businesses. News When societies discuss cryptocurrencies the argument that the decentralized and unregulated nature of the crypto space leaves the door.

Five commercial banks operating in Kenya were fined 375 million due to disruptions in AML compliance processes. When societies discuss cryptocurrencies the argument that the decentralized and unregulated nature of the crypto space leaves the door open to abuse like money laundering and financial fraud is often put forward by officials and authorities. However a string of cases involving precisely these sins and many many banks show that regulations are largely ineffective.

The Central Bank of Paraguay levied a record-breaking fine against Banco Itau a major Brazilian bank for failing to comply with AML regulations. M oney laundering is the process of making illegal income appear legal without arousing the suspicions of banks or law enforcement. Kenya Fines 5 Banks 375 Million for Anti-Money Laundering Violations.

On March 4 2020 the Treasury Departments Financial Crimes Enforcement Network FinCEN issued a consent order assessing a 450000 civil money penalty against Michael LaFontaine a former Chief Operational Risk Officer at US. Failure to adhere to anti-money laundering AML protocols was the most common banking violation that led to substantial fines being imposed on financial institutions last year according to data in Finbolds Bank Fines Report 2020. Smaller banks just like the bigger ones need to fully understand and follow the 312 due diligence requirements if they open up accounts for.

Whenever you are looking at any entity check to see whether it has rebranded itself to escape a dark past that it doesnt want you to uncover. The fine exceeds the banks. The ECBs decision first disclosed by Austrias financial regulator follows an institutional decision to exit the banking sector.

Show that regulations are largely ineffective in preventing this type of violations especially when they are committed by the big traditional players. More Banks Sanctioned for AML Fraud-Related Violations When societies discuss cryptocurrencies the argument that the decentralized and unregulated nature of the crypto space leaves the door open to abuse like money laundering and financial.

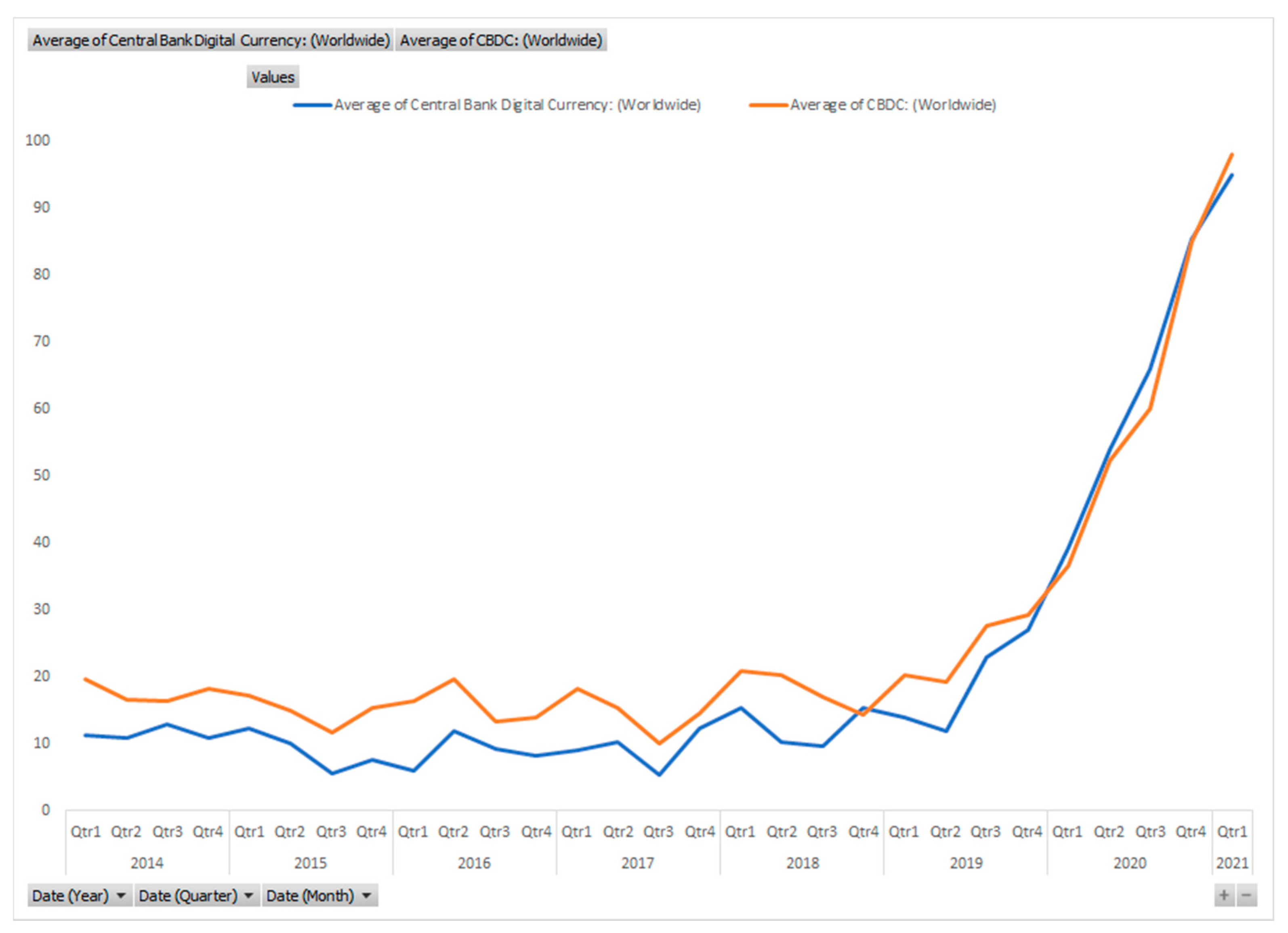

Top Chinese Banks Promote Cbdc Over Local Payment Firms For Shopping Festival Blickblock Re

Anti Money Laundering Aml Investigation Money Laundering Investigations Case Management

Bernardo Nicoletti Auth Mobile Banking Evolution Or Revolution Strategic Management Mobile Phones

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Money Laundering Evaluation Employee Employee Evaluation Form

Financial Condition And Options 13july2018 Final Balance Sheet Banks

Navigating Turbulent Changes To The Sanctions Landscape

Report Banking Giant Natwest To Refuse Service To Businesses That Accept Cryptocurrencies Jackofalltechs Com

A Crackdown On Financial Crime Means Global Banks Are Derisking Financial Money Laundering Crime

3 6 Billion Crypto Heist South African Bank Denies Business Relationship With Fraud Accused Africrypt Jackofalltechs Com

Bernardo Nicoletti Auth Mobile Banking Evolution Or Revolution Strategic Management Mobile Phones

Fintech Magazine August 2020 By Fintech Magazine Issuu

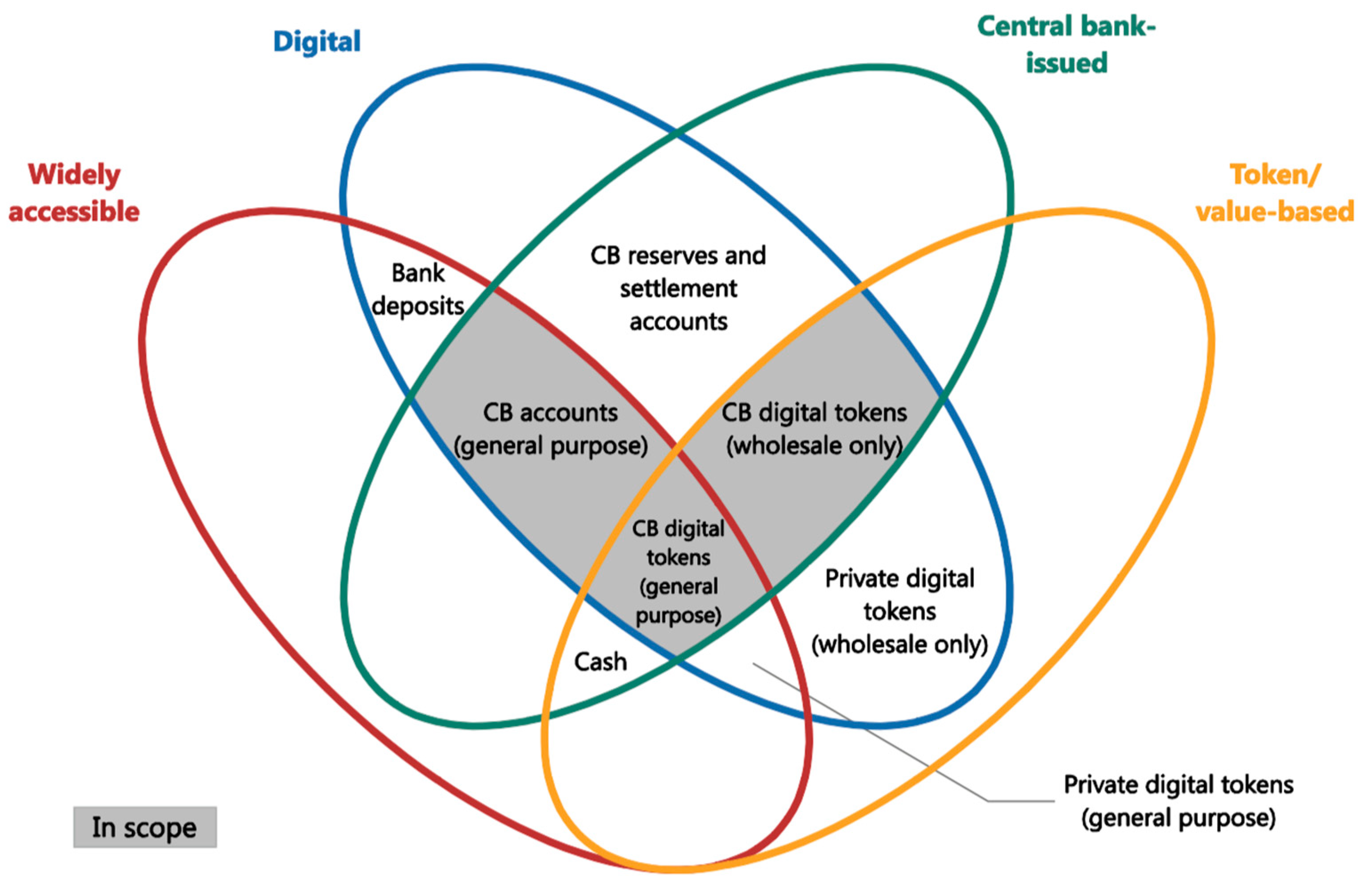

Future Internet Free Full Text From Bitcoin To Central Bank Digital Currencies Making Sense Of The Digital Money Revolution Html

Anti Money Laundering Aml An Overview For Staff Prepared By Msm Compliance Services Pty Ltd Bank Secrecy Act Act Training Money Laundering