Some central banks demonetize bank notes after legal tender status has been removed which means that they cease to honour their face value. Chase bank pulling out of Canada and forgiving customers credit card debt.

Aml Knowledge Centre Org Canadian Banks Money Laundering Controls Failed

RBS had exited similar panels in Tokyo and Hong Kong and Barclays PLC plans to pull out of the rate-setting panel for interbank lending in the United Arab Emirates.

Canadian banks are pulling out of. Canada banks are pulling out of antigua and barbuda. CANADIAN BANKS ARE PULLING OUT OF ANTIGUA AND BARBUDA In the aftermath of the very public controversy over the attempts of Antiguan business and political interests to forcefully acquire the local branch of the Bank of Nova Scotia Scotiabank rather than see it sold to the Trinidad-based Republic Bank it has been widely reported that all. In accordance with amendments to the Bank of Canada Act and the Currency Act approved by Parliament in 2018 the federal government recently decided to remove legal tender status from some older bank notes as of January 1 2021.

Just last month I learned that my friendly neighbourhood branch was going to close. Banks are expensive to run says Carleton University business professor Ian Lee. In the US forgiven debt is considered income for tax purposes.

DAGLI ORTIDEA via Getty Images This 1000 Canadian bank note which features Queen Elizabeth was issued in 1988. Private Debt Steps In for Canadian Companies as Banks Pull Back. In other words demonetized bank notes lose their value.

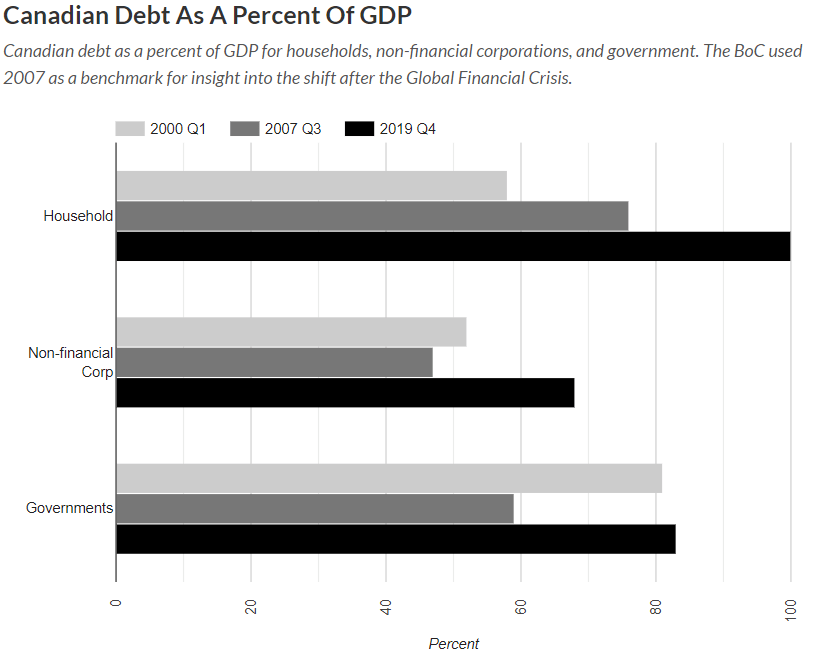

Bank fee hikes can easily make people angry especially when those financial institutions are. DBRS Moodys and Standard and Poors all have downgraded Canadian banks to a negative outlook. Box 500 Station A Toronto ON Canada M5W 1E6.

The Canadian banks used to face tough competition from the likes of Barclays and Citibank but that started to change at the turn of the century. Royal Bank pulls out of the Caribbean. There are currently no plans or legal means to demonetize bank notes in Canada.

Chase Bank which announced in March 2018 that it was pulling out of the credit card market in Canada has now told its customers there that it is forgiving all their debt the company told U SA. Canadas Major Banks are hiking fees - pulling in big profits Published on May 9 2017 May 9 2017 3 Likes 4 Comments. Banks weighed up the reputational risks from an opaque benchmarking system at the center of a global rate-rigging scandal as the Royal Bank of Canada pulled out of a bid rigging panel that set interbank lending rates to misrepresent their assets profits and financial statements misleading investors in the.

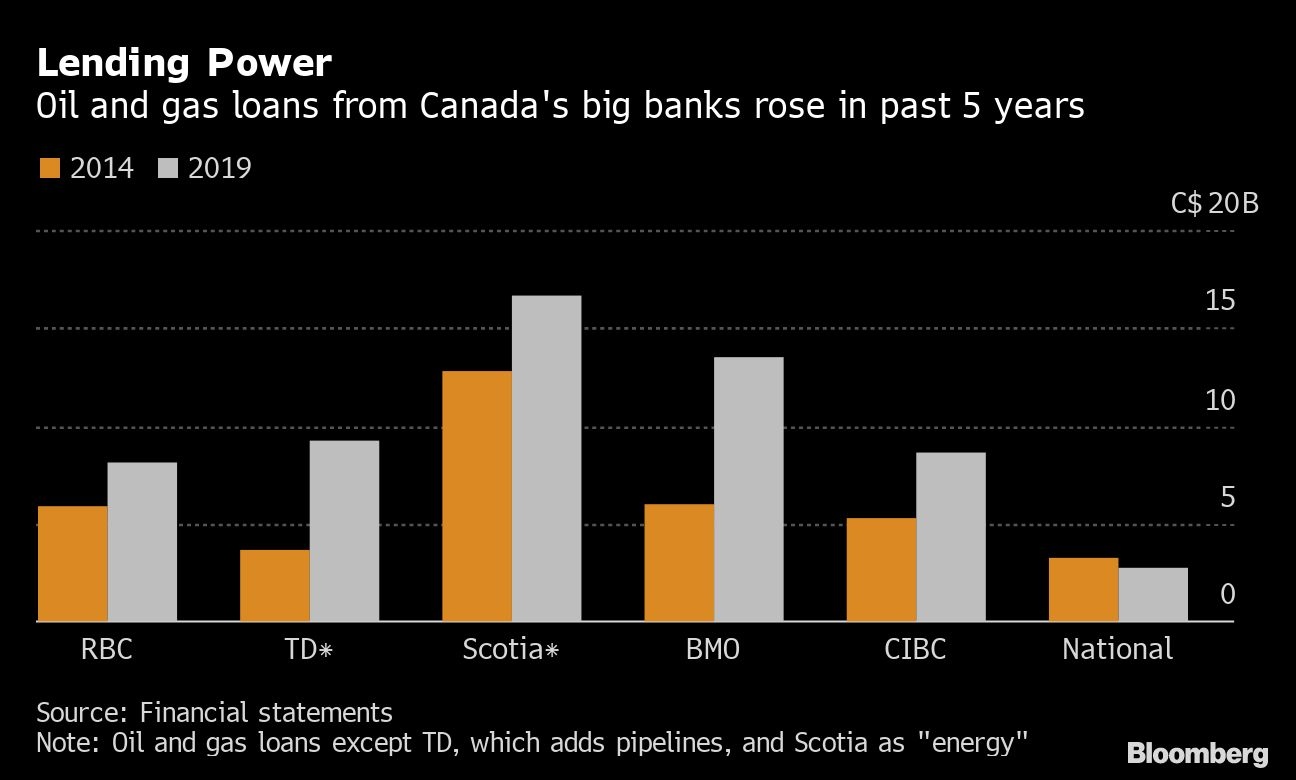

As Bloomberg headlines go this one is pretty exciting to a private debt fund. Regardless of whether US. Banks pulling back despite pressure from government SME interest groups and the marketplace.

Almost all of Canadas big banks are doling out some kind of personal banking fee increase this year. How to redeem older bank. Bank Of Canada Pulling Older Bank Notes Out Of Circulation By 2021 A.

So if you just used one of their credit cards to purchase a killer Pentax system congratulations. In 2001 CIBC combined its regional operations with. In some parts of the country those financial institutions that have been ballsy enough to do business with the cannabis industry since the days of President ObamaContinue Reading.

They may be costly operations but some also pull in plenty of cash. Audience Relations CBC PO. All that will be left of TD Canada Trust is TD Bank - just another money-grubbing member of Canadas Big Five.

On Monday Royal Bank of Scotland said it had removed itself from a panel in Singapore that sets interbank lending rates there following an internal review. The Bank of Canada says our housing market is 30 overvalued Deutsche Bank says 63 and. Attorney General Jeff Sessions ever plans to launch an official crackdown on legal marijuana his scare tactics are working.

On Monday Royal Bank of Scotland said it had removed itself from a panel in Singapore that sets interbank lending rates there following an internal review. Following similar moves by its competitors Royal Bank of Canada says it is shrinking its wealth management business and cutting jobs as it severs ties with. Last month TD reported a second-quarter profit of 205 billion up from 186 billion in the same period last year thanks largely to retail bank earnings.

This change will affect the 1 2 25 500 and 1000 notes which are no longer being produced. RBS had exited similar panels in Tokyo and Hong Kong and Barclays PLC plans to pull out of the rate-setting panel for interbank lending in the United Arab Emirates.

Best Banks Stocks In Canada 2020 University Magazine

Canadian Banks Going Green Still Boost Loans To The Oil Industry Bnn Bloomberg

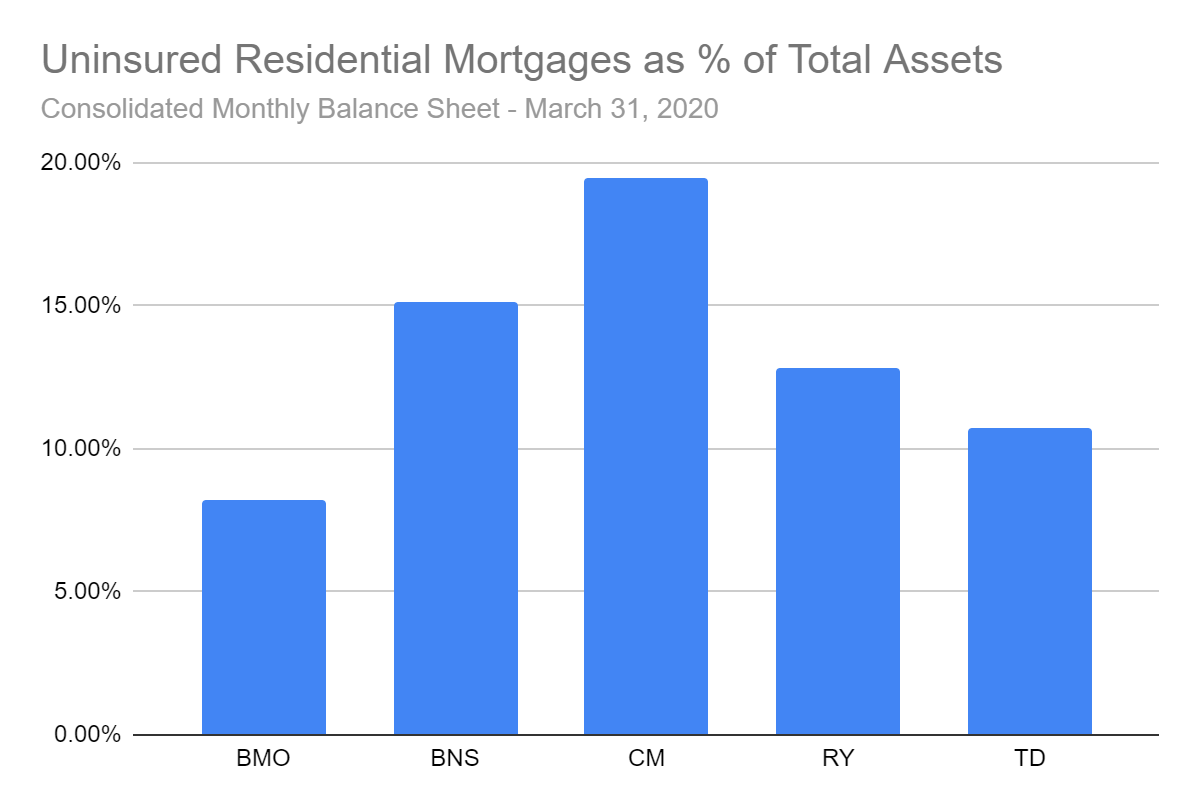

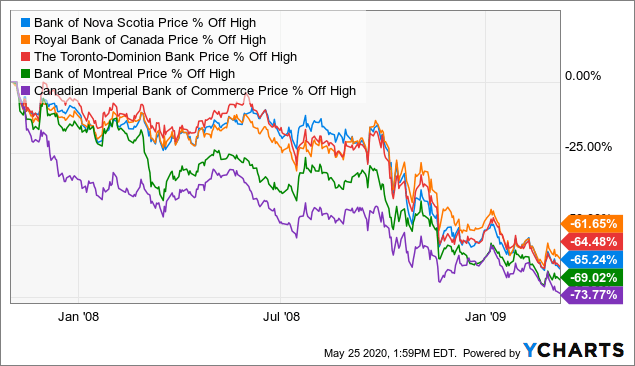

Canadian Housing Collapse And The Big 5 Banks Seeking Alpha

Canadian Housing Collapse And The Big 5 Banks Seeking Alpha

Canadian Housing Collapse And The Big 5 Banks Seeking Alpha

It S Canada Day Eh Canada Day Canada Day Crafts Canada Day Party

It Is Scaring A Lot Of People Banks Closing 20 Rural Sask Branches In 2017 Cbc News

Experience Royal Financial Provider With Royal Bank Of Canada Royal Bank Banks Logo Royal Family Of Greece

Pin On Oh The Places You Will Go

Canadian Housing Collapse And The Big 5 Banks Seeking Alpha

The Bank Of Canada Is Printing Money Like Crazy Spencer Fernando

National Bank Of Canada 1 800 Customer Service Support Phone Number Canada Logo Bank Canada

Make The Switch From The Big Five Banks Climate Momentum

Canadian Housing Collapse And The Big 5 Banks Seeking Alpha