Among these outcomes are. It is based on papers shared on 7 and 23 April with the FATF Global Network of FATF Members and FATF-Style Regional Bodies FSRBs together making up more than 200 jurisdictions.

What Are The 9 Fatf Style Regional Bodies Fsrbs Sygna

This report was completed simultaneously with a 12-month review of the implementation of revisions to the FATF Standards.

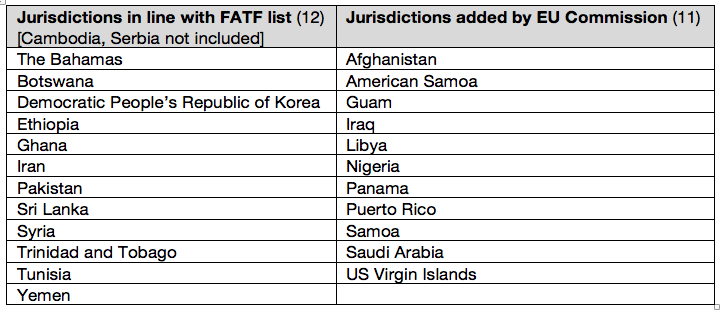

Fatf issues its country amlcft report. The FATF Standards clearly apply to so-called stablecoins and their service providers. It has highlighted COVID-19 related threats and vulnerabilities as well as policy responses to address them. The FATF issues two public documents that provide a list of jurisdictions considered to pose a higher risk of money laundering and the funding of terrorism in view of a number of identified deficiencies within their AML CFT regime.

Topics discussed by attendees included Iranian terrorist financial risks guidance related to stablecoins and virtual assets and reports related to anti-money launderingcountering the financing of terrorism AMLCFT. FATF Report to G20 Finance Ministers and Central Bank Governors. Treasury Department released a public statement issued by the Financial Action Task Force FATF following the conclusion of its plenary meeting held October 16-18.

FATF Report to G20 Finance Ministers and Central Bank Governors July 2018 Download pdf 501kb Paris 18 July 2018 The FATF published its report to the July 2018 G20 Finance Ministers and Central Bank Governors. The report sets out FATFs ongoing work to fight money laundering and terrorist financing and in particular in the following areas in which the FATF. SPNFT od A do From A to Z on AMLCFT.

FATF is consulting private-sector stakeholders on the text of this Draft RBA Guidance for the Securities Sector. An update on the FATF greylisting of Malta - Zerafa During its last plenary session held on the 23rd June 2021 the Financial Action Task Force FATF voted to insert Malta in its list of countries that have been identified as having strategic anti-money laundering AML deficiencies the so called grey list. The standards ensure that virtual assets are.

Paris 6 July 2017 The FATF published its report to the July 2017 G20 Leaders Summit. FATF has issued global binding standards to prevent the misuse of virtual assets for money laundering and terrorist financing. 06 Jul 2018.

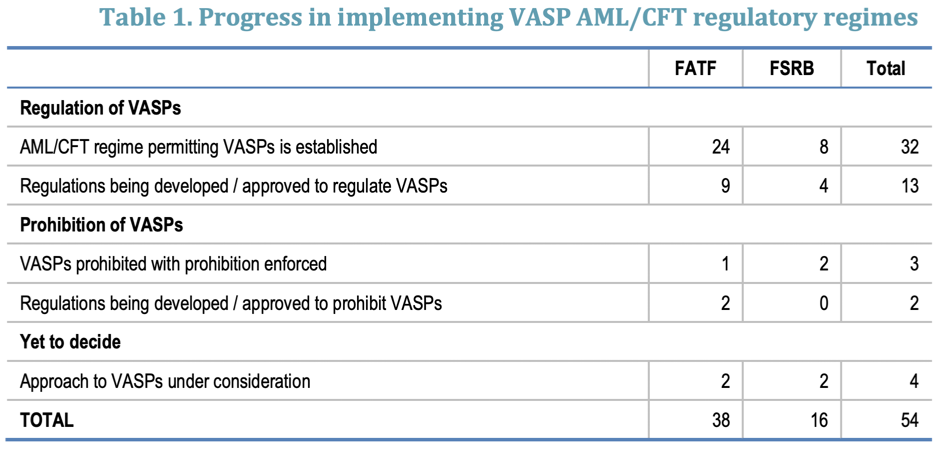

Methodology for assessing technical compliance with the FATF Recommendations and the. In June 2019 the FATF strengthened its Standards to clarify the application of anti-money laundering and counter- terrorist financing requirements on virtual assets and virtual asset service providers. For the risks to be mitigated all countries need to effectively implement these standards.

The FATF is developing guidance to assist countries competent authorities and the securities sector in the application of a risk-based approach RBA to AMLCFT in the Securities Sector. The FATF conducts peer reviews of each member on an ongoing basis to assess levels of implementation of the FATF Recommendations providing an in-depth description and analysis of each countrys system for preventing criminal abuse of the financial system. The FATF typologies report examines the abuse of the NPO sector through a wide lens because the activities and therefore vulnerabilities of the sector extend beyond its financial flows to include material support.

Until then it had already been closely involved in the work of the FATF through its participation in MONEYVAL. Specifically the FATF discussed the. The FATF also periodically issues a public statement on jurisdictions and countries which its regards as having strategic AMLCFT deficiencies and which have provided high level political commitments to working towards improving their AMLCFT frameworks and will highlight jurisdictions which has made any significant progress in improving the identified deficiencies.

The final draft is then presented by the Assessment Team and assessed country to the CFATF Plenary for discussion and approval by all members. As the global standard setting body for anti-money laundering and combating the financing of terrorism AMLCFT The Financial Action Task Force FATF identifies jurisdictions that have strategic deficiencies and works with them to address those deficiencies that pose a risk to the international financial system. As of October 2018 the FATF has reviewed over 80 countries and publicly.

On October 18 the US. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. The FATFs 12-month review of these revisions complement the findings.

In October the FATF President Marcus Pleyer of Germany presented our report to G20 Finance Ministers and Central Bank Governors. The risks posed by the jurisdictions listed in these two documents vary depending on the seriousness of the deficiencies and the level of commitment made. Terrorist financing During this Plenary year tackling the threat of terrorist financing continued to be a priority for the FATF which included the publication of a new guidance to help countries.

The report as adopted by Plenary is then published14. Despite the exceptional circumstances the FATF has continued advancing its important work. SPNFT od A do From A to Z on AMLCFT Menu Close Regulations.

On 10 December 2018 FATF and MONEYVAL published a mutual assessment report on Israels anti-money laundering and counter-terrorist financing AMLCFT system the effectiveness of measures in place and their level of compliance with FATF Recommendations. On September 15 th FinCEN issued its latest Advisory on FATF-Identified Jurisdictions with AMLCTF Deficiencies The FATF or the Financial Action Task Force is a 37-member intergovernmental body including the United States that establishes international standards to combat money laundering and the financing of terrorism. The authors thank the FATF members observe rs the FSRB Secretariats and their members for their contribution to the report.

Juan Manuel Vega-Serrano the FATF achieved a number of important outcomes which are set out in the FATF Annual Report 2016-2017. That report is then provided to the assessed country for comment and a revised draft is circulated to the other CFATF member countries for comment. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year.

This is to protect the international financial system from MLTF risks and to. FATF Report to G20 Leaders Summit July 2017. This report was written by Kristen.

Under the Spanish Presidency of Mr. Israel became an observer to the FATF in February 2016. As part of its listing and monitoring process to ensure compliance with its.

The abuse of the NPO sector by terrorists or terrorist organisations raises a number of complex strategic issues which is discussed in great length along with providing recommended solutions and. The FATF advises its memberships to consider the risks arising from the deficiencies in each country.

Mexico Rallies In Several Areas Of Aml But Dnfpbs Remain A Problem New Fatf Report Reveals Aml Intelligence

Publications Financial Action Task Force Fatf

Financial Action Task Force Fatf

The Financial Action Task Force An Introduction By Cmi Chr Michelsen Institute Issuu

Pdf Money Laundering Fatf Special Recommendation Viii A Review Of Evaluation Reports

Documents Financial Action Task Force Fatf

Opinion Caught Between Fatf S International Cooperation Review Group Process And Eu S List Of High Risk Third Countries Aml Intelligence

Fatf Turns 30 The Evolution And Impact Of The Aml Cft Standard Setter Part 1 By Denisse Rudich Linkedin

Pdf Re Thinking Fatf An Experimentalist Interpretation Of The Financial Action Task Force

Documents Financial Action Task Force Fatf

Aml Country Reports An Introduction To The Fatf Mutual Evaluations Planet Compliance

The Controversial Eu List Of High Risk Third Countries Global Risk Affairs

Opportunities And Challenges Of New Technologies For Aml Cft

Pdf An International Analysis Of Fatf Recommendations And Compliance By Dnfbps

3 Key Lessons From The Fatf S Report On Its Virtual Asset Review

Fatf Annual Report 2017 2018 By Financial Action Task Force Issuu

Documents Financial Action Task Force Fatf

Fatf Effectiveness Assessment Framework Download Scientific Diagram