When a bank instigates foreclosure proceedings under invalid circumstances whether due to mismanagement or intentional wrong-doing they could be committing wrongful foreclosure. This is an unfortunate fact and a debtor should be well aware of the Fair Debt and Collection Practices Act to use.

Foreclosure Loopholes Lovetoknow

Robosigning involves the use of bogus documents to force foreclosures without lenders having to scrutinize all the paperwork involved with mortgages.

The illegal foreclosure tactics. Illegal Tactics Used by Debt Recovery Companies. Lawyer Decisions and Illegal Conduct. Legal aid offices in California Nevada Florida Michigan and New York say calls about Safeguards aggressive tactics rank among the top complaints.

A creditor is only one who either a owns the debt or b represents someone who owns the debt. It is also possible that the note has been lost or misplaced because of the divided ownership of the property. Every morning I read the recent cases news articles and other blogs with an eye toward developing strategies and tactics that will get at the truth of the mortgage disaster.

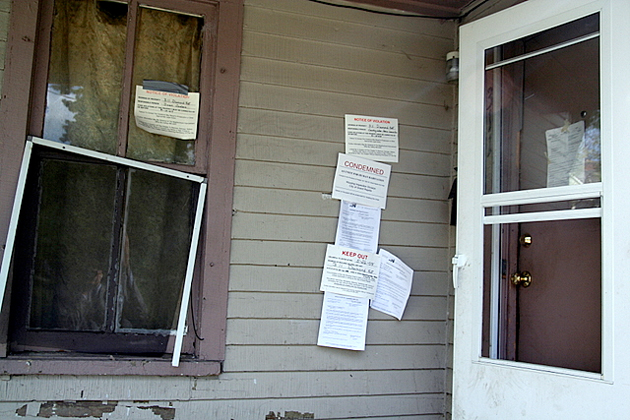

Sometimes there are plans or rehabilitation options that can reverse the road to foreclosure. Allowed hundreds of foreclosed properties to fall into disrepair and facilitated the illegal eviction of hundreds of low-income tenants. The illegal foreclosure tactics employed by fay servicing This blog shall continue to report on the financial criminals who are hell bent on making Americans homeless.

Posts about illegal foreclosures written by Neil Garfield. Collier will file a claim for wrongful foreclosure and be paid from any settlement. But the firms are coming under fire for using questionable and possibly illegal tactics.

Social considerations might necessitate a negotiation in lieu of foreclosure even though the law is clear on your companys right to take the business due to the terms of the security agreement. You can also file a lawsuit if you think the foreclosure is illegal. GO TO THE HOME PAGE AND SIGN UP FOR BOTH.

These foreclosure delay tactics are not disingenuous or illegal. Rather they are mechanisms provided to property owners under the law that often result in a better result for both the lender and property owner. Predatory lenders typically target minorities the poor the elderly and the less educated.

Wrongful foreclosure can occur when foreclosure processing companies submit documents to courts that have not actually been signed by homeowners and bear a forged signature. The scrutiny threatens to ensnare JPMorgan Chase Bank of America Citibank and other lenders that depend on the firms. Because of this the collection industry feels they can break the law with little consequence.

The practice was at the heart of the foreclosure scandal that led to a 25 billion settlement between the US. In some cases such as those involving a lenders failure to provide notices or bad faith lending tactics these foreclosures. US Bank foreclosure tactics targeted.

While this is a terrible thing to have to work through it is even more upsetting when the foreclosure process involves illegal actions on behalf of the lender. Government and five major banks last week. WHY YOU SHOULD SIGN UP FOR MEMBERSHIP AND SEND A DONATION.

Ownership of the debt is only accomplished in one way payment of value in exchange for an instrument conveying title to the debt from an owner of the debt to a new owner of the debt. Debt recovery companies are not as highly regulated as banks and credit card companies. By definition predatory lending benefits the lender and ignores or hinders the borrowers ability to repay the debt.

Russell also thinks the LaRaces are owed something for the cost of repairing their home. This also means your legal team has more time to gather additional proof and evidence of the banks illegal conduct. From the outset of the case the lawyer and client should determine the scope of the representation.

This practice not only. If that does not work and the home is still being foreclosed on you can present defenses to foreclosure to the lender. In order to foreclose the party asking for foreclosure remedy must be a creditor.

One of the most common illegal foreclosure practices is dual tracking when the lender moves forward with the process of foreclosure while at the same time processing a loan. These lending tactics often try to take advantage of a borrowers lack of understanding about loans terms or finances. This practice misleads homeowners inducing them to believe that their monthly payments will be lowered but instead lenders often deny requests for loan modifications within a few days of foreclosure making it very.

Russell will do the same. If you are facing a hotel foreclosure you are not at the mercy of your lender. The first thing to try is reasoning with or working with the lender.

If you have not previously read our coverage of Fay Servicing you are invited to visit our prior article here. When no note is produced the foreclosure proceedings are halted thus giving you time to arrange your finances.

The Great Eviction Black America And The Toll Of The Foreclosure Crisis Mother Jones

Foreclosure Press Room Fraud Stoppers Mortgage Foreclosure Relief

What Is Foreclosure Fraud Howstuffworks

Kenneth Rijock S Financial Crime Blog The Illegal Foreclosure Tactics Employed By Fay Servicing

Low Bar How Lawyers Profit Off Desperate Homeowners Center For Public Integrity

Foreclosure Press Room Fraud Stoppers Mortgage Foreclosure Relief

What Is Foreclosure Fraud Howstuffworks

What Is Foreclosure Homes Mean And How It Work Homeia

Kenneth Rijock S Financial Crime Blog The Illegal Foreclosure Tactics Employed By Fay Servicing

Kenneth Rijock S Financial Crime Blog The Illegal Foreclosure Tactics Employed By Fay Servicing

Mortgage Foreclosure Strategies Kleinman Llc Uniondale Ny Attorney

Http Www Osbarcle Org Library 2012 Fp12 Handbook Pdf

Foreclosure Defense Discovery In A Foreclosure Case How To Get A Bank To Give Up Important Information And Documents Long Island Bankruptcy Foreclosure Law Firm

How You Can Stop A Foreclosure From Nationstar Mortgage Mr Cooper

What Is A Wrongful Foreclosure Loan Lawyers

Foreclosure Defense Mortgage Modifications How To Stay In Your Home

Wells Fargo Wrongful Foreclosure Class Action Lawsuit Gets Certified Top Class Actions

Foreclosure Attorney San Gabriel Ca Pasadena Rodriguez Law Group Inc

Here Is What Is Really Wrong With Foreclosure Process Fraud Stoppers Mortgage Foreclosure Relief